Despite external risks, Tajikistan’s economy continues to demonstrate steady and resilient growth. According to the Eurasian Development Bank (EDB), GDP is projected to grow by 8.4% in 2025, followed by 8.0% in 2026 and 7.1% in 2027, outpacing the regional average, Asiaplus.tj reports.

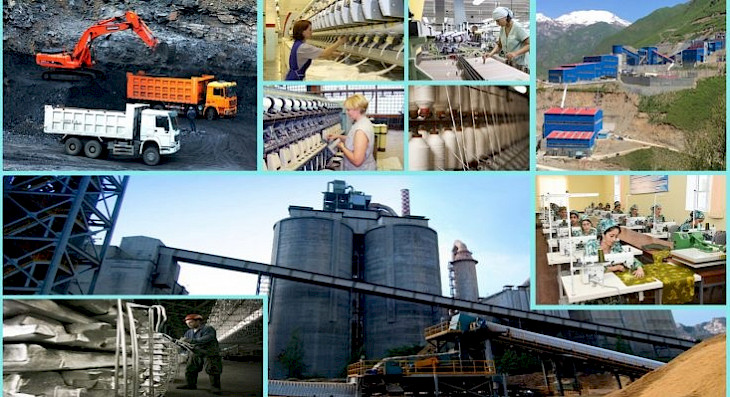

This growth is driven by strong domestic demand, fiscal support, investments in key sectors, and high global gold prices - Tajikistan’s main export commodity. In the first quarter of 2025, GDP grew by 8.2% year-on-year. The most dynamic growth was observed in:

-

Industry (+23.4%)

-

Trade (+10.6%)

-

Freight transport (+18.7%)

-

Passenger transport (+16.6%)

-

Agriculture (+7.2%)

A major contribution came from non-ferrous and precious metal ore mining, which surged by 80% in just three months. The energy sector expanded by 10%, while manufacturing grew by a modest 2.1%, with recovery expected - particularly in the textile sector, after a poor cotton harvest.

Income and Consumption as Growth Drivers

Real household incomes are rising. In January–February 2025, the average real wage increased by 21.6%, boosting demand. Retail turnover grew by 8.1%, and remittance inflows in Q4 2024 jumped by 20.8%, further supporting consumer spending.

Investment and Foreign Trade

Fixed capital investments declined by 10.1% in Q1 due to a high base effect from the previous year. However, a recovery is expected, supported by infrastructure projects and international financing.

Imports increased by 23.8%, reaching $1.9 billion, largely due to:

-

Transport equipment (+70%)

-

Machinery and equipment (+17%)

Exports fell by 15.7% to $0.5 billion, mainly due to the temporary suspension of gold shipments. As a result, the trade deficit widened to $1.3 billion, although a reduction is expected in the second half of the year.

The Tajik somoni appreciated to 10.33 per US dollar in May 2025 - a 5.4% gain since December - thanks to stronger export revenues and a weaker global dollar.

Inflation and Monetary Policy

Inflation stood at 3.6% in April, within the National Bank’s target range of 5% ± 2%, driven by exchange rate stability and lower global prices for food and energy.

Inflation is expected to remain within target in 2026–2027, though it could reach the upper bound (6%) amid sustained domestic demand, rising prices, and a possible weakening of the somoni.

In May, the National Bank of Tajikistan cut the refinancing rate to 8.25%, the lowest level in nine years, to stimulate the economy. However, the rate may be raised to 11% in 2026 to curb inflation if necessary.

Budget and Public Finances

Despite a 33% increase in public spending, the state budget remains in surplus, reaching 1.2 billion somoni (3.7% of GDP). The EDB notes that Tajikistan’s fiscal policy remains balanced and growth-oriented.

Outlook and Risks

Key risks include:

-

Slowing global economic growth

-

Falling commodity prices (especially gold and aluminum)

-

Reduced migrant remittances

Nevertheless, Tajikistan has tools to mitigate these risks: active fiscal policy, international investment, and potential import cost reductions.

CentralasianLIGHT.org

June 26, 2025