Turkmenistan, one of the world's largest natural gas suppliers, has been striving for decades to diversify its export routes to reduce its dependence on traditional buyers such as China, Eurasiatoday.ru wrote.

Particularly sensitive for Turkmenistan has been its one-sided dependence on a single major gas buyer, especially when, between 2019 and 2021, Turkmen gas supplies to China reached critical levels for various reasons. This event led to a worsening of Turkmenistan’s trade balance and likely had a direct impact on the country's economic situation, as well as an increase in protest sentiments.

Since then, Ashgabat's main goal has been to expand its gas markets and increase economic independence through new infrastructure projects, such as expanding gas supplies to Europe via either the Trans-Caspian pipeline or through SWAP and TAPI (Turkmenistan-Afghanistan-Pakistan-India). These projects not only open new markets but are also key to ensuring energy security for European and South Asian countries.

However, developments around Turkmenistan have long limited its ability to diversify gas buyers: on one hand, the virtual impossibility of implementing any gas projects through the Caspian Sea due to legal and environmental constraints, and on the other hand, restrictions related to the evolving situation in Afghanistan.

The current geopolitical situation in the region also brings its own adjustments. On one hand, China remains a key player in the Central Asian gas market, while on the other hand, Turkey, Iran, and Azerbaijan are actively involved in the development of transport and energy infrastructure.

The European Union, seeking to reduce its dependence on Russian gas, is also showing interest in cooperating with Turkmenistan. In this context, serious questions arise as to whether Turkmenistan can change the current situation and how likely it is that large-scale projects like the Trans-Caspian pipeline will be implemented.

Is it possible to break the status quo?

Currently, the main market for Turkmen gas is China. Since 2009, Turkmenistan has been exporting gas to China through the Central Asian gas pipeline, which was built with significant financial support from Beijing.

In the first half of 2024, Turkmenistan became the largest gas supplier to China, exporting gas worth $5.67 billion, significantly surpassing the volume of gas supplies from Russia, even though in February of this year both sides had stated that Russia had, for the first time, surpassed Turkmenistan in gas supplies.

In fact, both states may enter into a race to increase gas supplies not only to China but also to Central Asia. This was demonstrated by Turkmenistan's reaction to Russia's plans to expand the so-called "gas union," which was concluded with Kazakhstan and Uzbekistan.

On August 12, 2023, Turkmenistan’s Ministry of Foreign Affairs issued a statement from Murad Archaev, Deputy Chairman of the state corporation "Turkmengaz," saying that Russia's plans to create a "gas union" with Kazakhstan and Uzbekistan harmed Ashgabat's interests. This came after a statement by Dmitry Birichevsky, Director of the Economic Cooperation Department of Russia’s Ministry of Foreign Affairs, about the possibility of "expanding trilateral cooperation in the gas sector."

In 2023, it was known that Gazprom hoped that Central Asian countries would become buyers of 34 billion cubic meters of gas that the company had been unable to sell to Europe over the first 11 months of 2023 due to Western sanctions. In addition, Russia’s Ministry of Energy and Uzbekistan agreed on the inclusion of the Russian "System Operator" into the unified energy system of Central Asia.

Given that at the first meeting of energy ministers from regional countries, Turkmenistan was represented only by its ambassador to Kazakhstan, it can be assumed that Turkmenistan is the least interested in uniting its energy system in Central Asia.

Economic relations between Turkmenistan and China remain stable; however, Ashgabat’s dependence on one market creates certain risks. The key buyer can dictate terms, influencing gas prices, as well as controlling the volumes of purchases, which makes Turkmenistan vulnerable in the event of changes in demand or shifts in the economic policies of its main buyer.

In this context, Turkmenistan is looking for ways to diversify its supplies, considering markets in Europe, Turkey, Iran, and South Asia. It is also important to consider the realization of the fourth line of the "Central Asia-China" gas pipeline, whose launch has been delayed. Construction began in September 2014, but the project has largely stalled due to disagreements over prices among participating countries.

PetroChina expects to resume construction of pipeline line D in 2024, but this depends on the completion of the gas supply contract with Turkmenistan. Chinese President Xi Jinping called in May 2023 for the acceleration of line D construction as part of the energy partnership between China and Central Asia. The completion of line D construction will increase the total capacity of the Central Asia-China gas pipeline system to 85 billion cubic meters per year.

Resumption of construction in 2024 depends on the conclusion of a new gas supply contract between China and Turkmenistan. Completing line D is a priority task for China in order to further increase gas imports from Central Asia.

At the same time, Russia is actively promoting the expansion of gas supplies to China under the "Power of Siberia" project. However, pricing for Russian gas remains a contentious issue, as China is unwilling to pay more for it than Turkmenistan offers. Pricing is a key factor in the competition for gas exports.

Turkmenistan is negotiating gas supply contracts with China, with PetroChina pushing for lower prices than those of Russian gas. This has created a competitive pricing environment, where both countries must carefully craft their pricing strategies to maintain market share.

Iran also plays a significant role in Turkmenistan's gas strategy. In August 2024, plans were announced to increase Turkmen gas supplies to Iran to 40 billion cubic meters per year, which could open up opportunities for further gas exports through Iran to Iraq and Turkey via the swap scheme.

This scheme allows Turkmenistan to use Iran as a transit route for gas supplies to other markets, which is particularly relevant given the difficulties in implementing projects aimed at Europe.

Opportunities and challenges of the Trans-Caspian pipeline

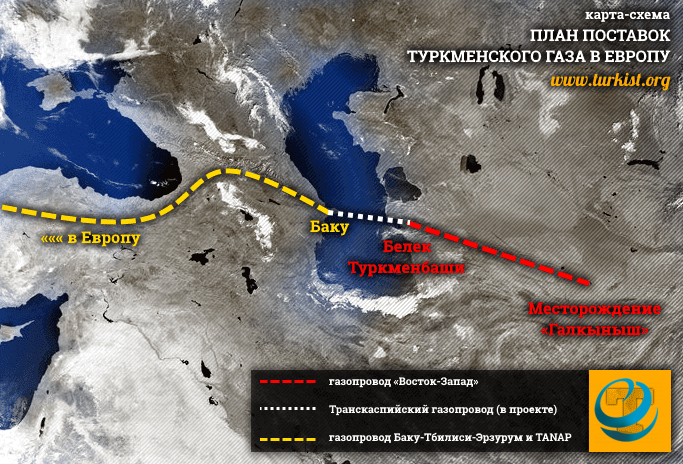

The Trans-Caspian Pipeline (TCP) project has long been discussed as a potential route for exporting Turkmen gas to Europe. It involves laying a pipeline along the bottom of the Caspian Sea to connect Turkmenistan with Azerbaijan, from where gas could be transported through Turkey to the European Union via the existing TANAP and TAP infrastructure.

This project is of strategic importance not only for Turkmenistan but also for Turkey and the EU, as it could significantly enhance Europe's energy security by reducing its dependence on Russian gas.

The U.S. is also actively supporting this project. U.S. Ambassador to Turkmenistan Elizabeth Rood stated that the implementation of the Trans-Caspian pipeline would benefit Turkmenistan, Turkey, and the European Union. American support for the project not only strengthens Turkmenistan's economic position but also fits into a broader geopolitical context aimed at weakening Russia's influence in the region.

Turkey plays a key role in advancing the project. In July 2024, Turkey’s Minister of Energy and Natural Resources Alparslan Bayraktar visited Ashgabat for talks on transporting Turkmen gas to Turkey and Europe. The Turkish side expressed interest in supplying 2 billion cubic meters of gas via swap through Iran in the first phase, with a long-term goal of up to 15 billion cubic meters annually through the Trans-Caspian pipeline. These gas volumes could ensure stable supplies to Europe for the next 20 years, which is an important factor for the region's long-term energy security.

However, despite political and economic support, the TCP project faces several serious challenges. First, building the pipeline requires significant investments, estimated at $5 billion, and with the European Union planning to reduce natural gas consumption after 2030, the likelihood of attracting such investments remains low. Second, Iran and Russia, citing environmental and legal concerns about the status of the Caspian Sea, continue to block the project, referring to potential threats to the region's ecology.

Nevertheless, Turkmenistan and Turkey remain hopeful about the project's realization. Turkey has already become a key gas hub for Azerbaijani and Russian gas supplies to Europe, and expanding its role through Turkmen gas would benefit both Ankara and Ashgabat.

CentralasianLIGHT.org

October 10, 2024